There are often fees for filing a court case online, particularly at its outset. To properly account for business expenses—and even recoup some of them through the billing process—it's important to understand how these fees are categorized.

eFiling fees can be classified in one of three ways:

Court fees

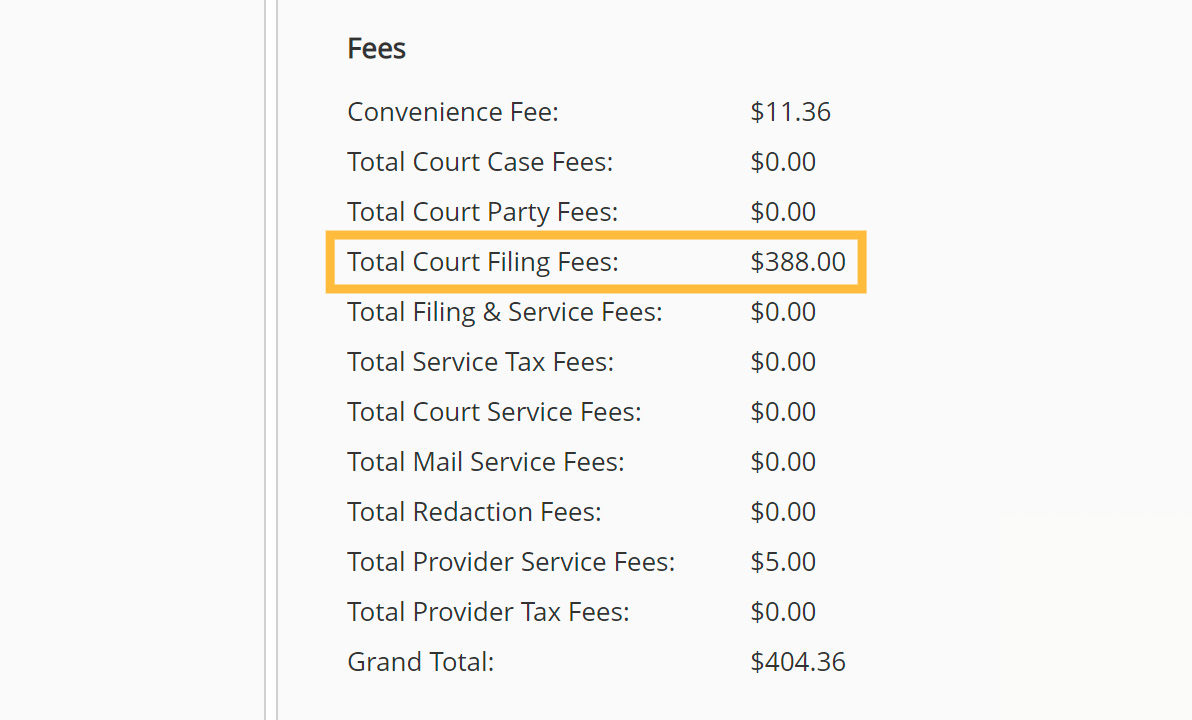

Fees listed under "Court Filing" are assessed by the court for processing your case. They appear more commonly on case initiations.

Usually, each case type will have its own fee that must be paid by the party filing the case. This is considered to be a mandatory fee unless the party files a valid fee waiver in lieu of payment.

Courts often have "optional" fee types as well. These fees are not mandatory to complete the filing process, but they may still be necessary for your particular case. For example, jury demands and requests for certified mail copies of a filing are both considered "optional" fees.

Service provider fees

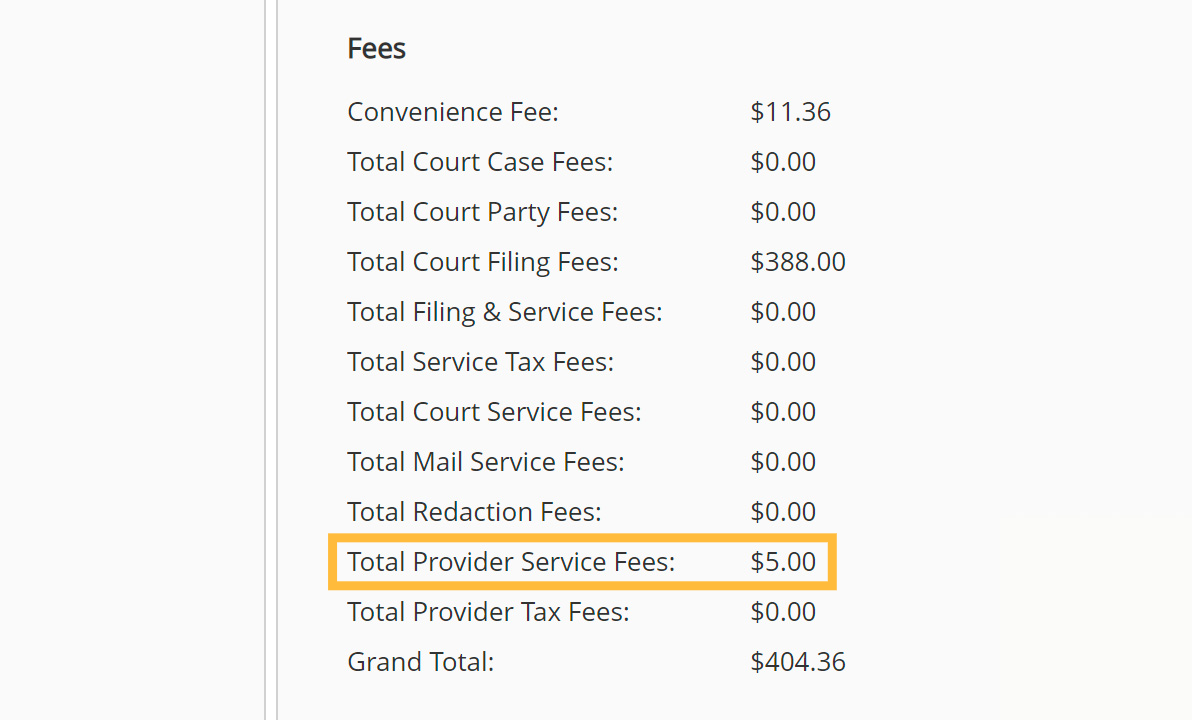

These fees are assessed by your eFiling service provider—in this case, InfoTrack.

While states may subsidize one or more EFSPs to provide free basic access to court filing for low-income filers, service fees charged by competing EFSPs finance the development of smarter, time-saving features that can be particularly advantageous to law firms that file frequently.

Service provider fees did not exist before the switch to electronic filing. However, they also enable the cost savings of being to file from any location instantly, without having to print forms and send a runner to the court.

Because many service provider fees are assessed per filing transaction, they are also technically easy to pass through to end clients. Today, many firms bill for these fees to reduce their technology expenses.

Payment processing fees

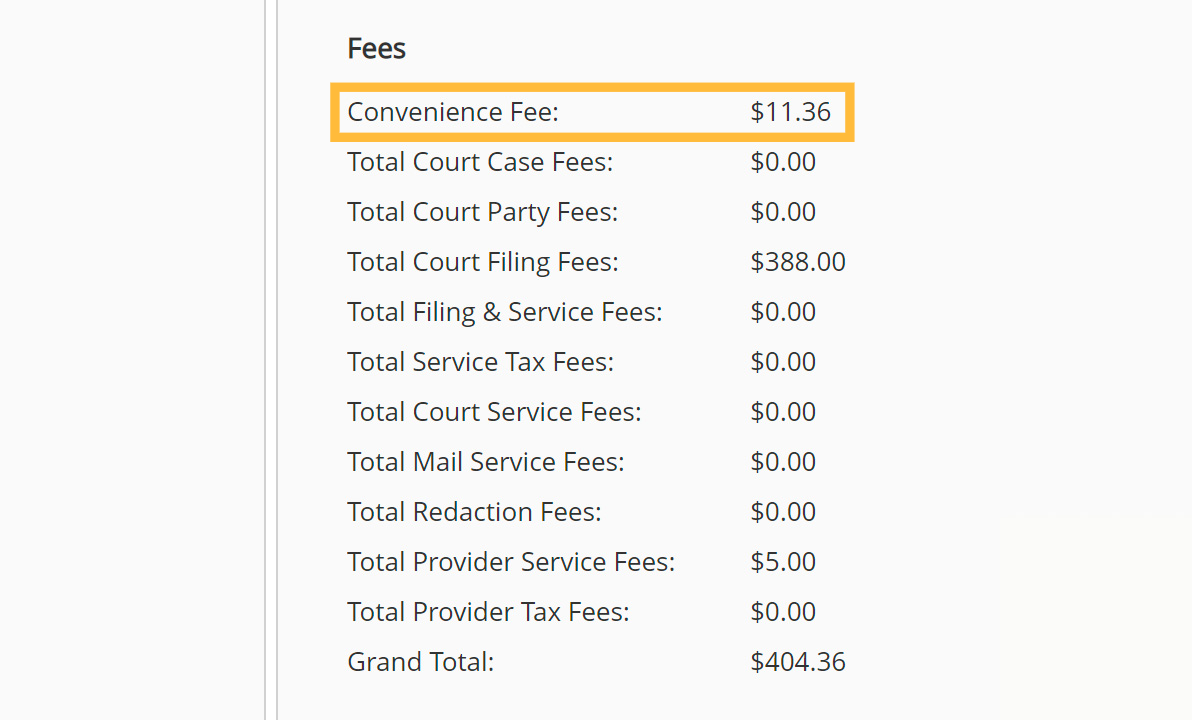

These fees are charged to cover the costs of credit card or ACH processing when sending your payment. Many state eFiling systems allow EFSPs to facilitate payment for a filer either by credit card or ACH (or eCheck).

Credit card payment processing fees are always charged as a percentage of the total value of the filing transaction—often between 2.9-3.3%. When court costs are in the hundreds of dollars, these fees can become more substantial.

ACH (or eCheck) payment processing fees are deducted directly from a bank account, and more often charged as a flat fee of between $0.25 and $1. The exact total may differ depending on the state where the transaction took place.

Therefore, when transactions involve larger court filing fees, it is generally more cost-effective to pay via ACH.

A credit card convenience fee ($11.36) charged as a percentage (2.89%) of a transaction with large court filing and provider service fees ($388 + $5). Here, paying by ACH would reduce the total expense of the filing by over $10.

A credit card convenience fee ($11.36) charged as a percentage (2.89%) of a transaction with large court filing and provider service fees ($388 + $5). Here, paying by ACH would reduce the total expense of the filing by over $10.